Are You Wondering What You Can Do to Protect You Businesses Long-Term Financial Health?

It is time to Fund Forward - MultiFunding has been on the front lines of unpacking and explaining the CARES Act to business owners and entrepreneurs from the beginning of the economic downturn. As a part of that ongoing conversation we curated a series of free webinars and a community group to discuss stimulus programs related to the Cares Act.

Business owners across the country have commented on how helpful Ami's insight has been to getting their piece of PPP and EIDL monies.

As we all move forward, unlike PPP & EIDL, where applying was easy and direct, MultiFunding can help you prepare and place your MSLP loan, getting you in front of the line with participating lenders.

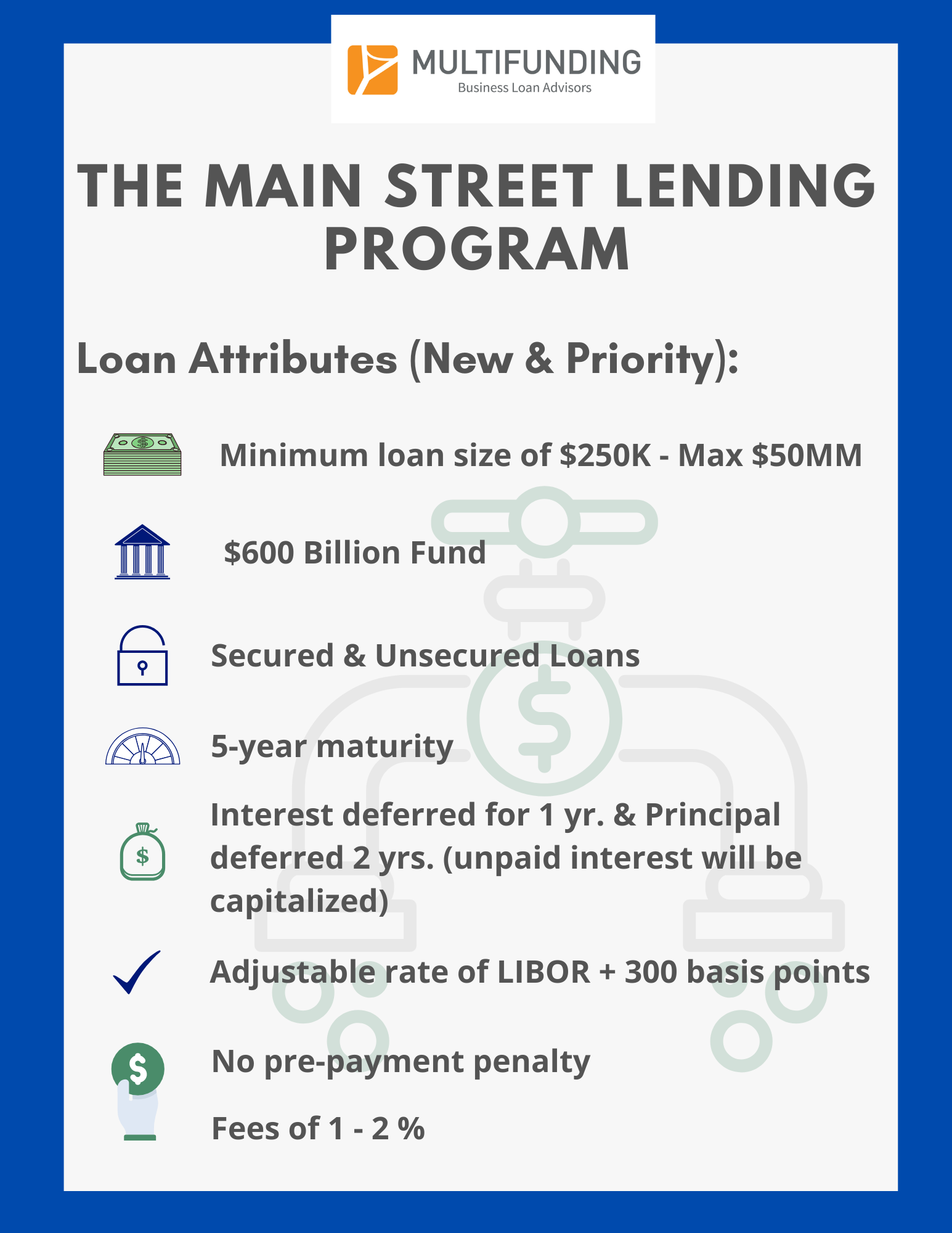

The MSLP loan, though more complex, is intended for small to mid-size companies who were in sound financial condition before the pandemic. With low interest rates, deferred payments, and favorable terms, MSLP was intended to save businesses, not employees.

We understand the Treasury Departments guidance and process better than most lenders, which allows for easy and successful outcomes for our clients. We make what can be an overwhelming loan process accessible and streamlined.

MultiFunding wants to help you finance your future.

Understanding MSLP Loans

MultiFunding Advisors are well versed in the regulations for this product.

In this unpredictable environment, cash is king and everyone should plan accordingly.

Please note, to benefit from this product, your business had to have positive cash flow in 2019 and continue to do well in 2020.